Harvey John

Unit 2 Ferry Wharf

Hove Enterprise Centre

Basin Road North

Portslade, East Sussex

BN41 1BD

The global economy may have slowed since 2021, but the job markets in OECD countries have remained remarkably tight in light of rising inflation. Employment seems to have recovered since the pandemic and unemployment is at its lowest level in decades. The current situation presents both opportunities and challenges for job seekers and employers alike.

As we delve into the OECD Employment Outlook 2023, we’ll explore the existing trends, what we’re observing across the Accountancy, Tax & Treasury markets and the looming impact of artificial intelligence (AI) on the labour market. We’ll also discuss how organisations can approach recruitment to build resilient and inclusive workforces for the future.

The Current Employment Landscape

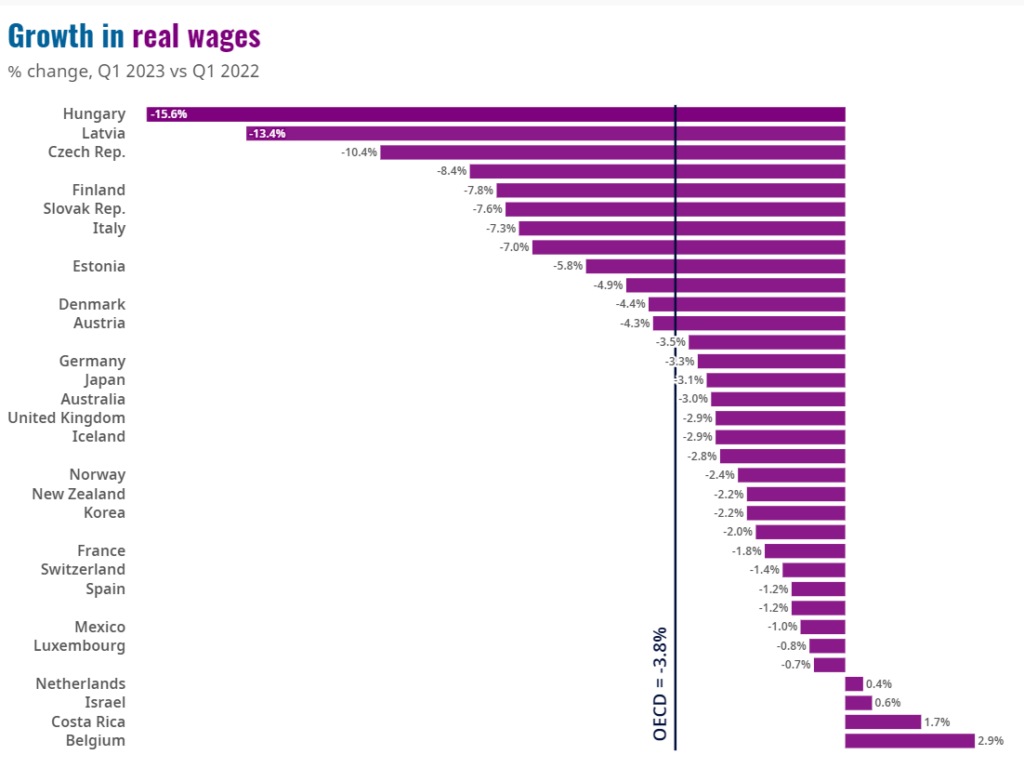

The OECD Employment Outlook 2023 reveals promising projections for employment in the coming years. As of May 2023, the OECD-wide unemployment rate remains at a record low of 4.8%, and it’s expected to expand further in 2023 and 2024. While this is good news for job seekers, real wages are dropping in almost all OECD countries.

Nominal wages are slowly picking up. However, as the cost of living crisis continues, ‘real wages’ are on the decline with an average -3.8% fall across the OECD.

Source: OECD – OCDE

In this tight job market, employers should try and adopt strategic recruitment practices to attract top talent. Offering competitive wages that keep up with the rising cost of living can be a crucial factor in attracting and retaining skilled professionals.

What we’re observing across Accountancy, Tax & Treasury…

Georgina Trudgill, Associate Director, Accountancy & Finance

“Over the past year, there has been a remarkable surge in job market salaries, with candidate expectations and client budgets for new roles reaching unprecedented levels. Even previously reluctant clients have raised their budgets, acknowledging the challenges of rising living costs and inflation for candidates. A scarcity of candidates has given job seekers more bargaining power in the market. Some roles that used to offer salaries around £25-26k have seen clients offering as much as £32k for junior candidates, while Accounts Assistants’ salaries have increased to £35-36k in certain cases. The competition for top talent is intense, with candidates juggling 3-5 interview processes. In some cases, offers have been £20k higher than candidates’ current salaries to attract sought-after Finance Managers. While this salary inflation is expected to stabilise within the next six months in the private sector, it represents a positive trend over the last year. Notably, the public sector is still lagging behind in wage improvement.”

Guy Middleton, Associate Director, Treasury

“Harvey John Treasury would have to agree with these OECD stats. With many businesses adopting company wide, flat rate salary increases in the region of 4-8% for 2023, real wages in the UK treasury market have understandably fallen over the past 12 months. And unless there has been significant government intervention, such as in Belgium and the Netherlands, the same can be said for the treasury market in other countries across Europe. Despite this, when moving jobs, the candidate short job market has meant that treasury professionals have been able to demand pay rises that are significantly above inflation, and this is likely to lead to an increasing number of individuals looking for other job opportunities going forward.”

“Salaries have been a contentious topic for quite some time in the tax domain. With it being such a candidate short market – and tax services becoming increasingly more in demand – professionals in the space have been able to enjoy higher remuneration than their peers in other areas of the broader accounting profession. Up until early this year, we saw many tax professionals take advantage of the surge in demand and inflationary issues to leverage higher salaries. Over the last quarter, we are starting to see pay pressures on employers soften given a downturn in demand but it still proves to be a divisive topic as the candidate market expects more given the rising cost of living. For a thorough insight into tax salaries across the UK & Europe, check out our Tax Salary Guides for 2023″

Callum Mckenna, Associate Director, Accountancy & Finance

“The decline in ‘real wages’ by -2.9% in the UK may be attributed to several factors, particularly the shift to remote work and the increased flexibility offered by employers. Perhaps these shortcomings in pay are a reflection of working from home and clients now offering a greater degree of flexibility. In some cases, we have observed that some employers will offer a fully or mainly home-working role, but it feels that this can be in exchange for salary. If these existing employees were underpaid relative to the market rate a couple of years ago, they could now be significantly behind in terms of cost of living increases. On the positive side, there have been instances where businesses have responded to market changes by implementing company-wide 10% pay increases to address market changes.”

Looking ahead – the looming impact of AI on the Labour Market

The OECD Employment Outlook also highlights the looming AI revolution, which is expected to transform the way we work. Rapid progress in AI and increased availability of workers with AI skills suggest that significant changes are on the horizon.

As AI evolves, there are concerns about potential negative impacts on employment. PwC’s annual global workforce survey revealed that “almost a third of respondents said they were worried about the prospect of their role being replaced by technology in three years.”

Organisations should start considering the skills needed for the AI-powered workforce and invest in training and upskilling programs. Companies can ensure their workforce is prepared for the technological shift. They can do this by integrating AI skills into education and encouraging employers to provide more training opportunities,.

In light of the disruptive impact of AI on traditional job roles, it is more important than ever to foster a sense of inclusivity in the workforce. There needs to be a focus on diversity, equity & inclusion in hiring practices. Companies need to recognise the value of a varied workforce. One way to help those who are struggling financially is by providing targeted assistance to low-income households. This can be done through measures such as minimum wage increases, collective bargaining, and tax benefits.

In the coming weeks, keep your eyes peeled on our Media Hub for blogs covering how AI will impact the Accountancy, Tax, Treasury & Legal markets.

Conclusion

The OECD job markets have demonstrated resilience in the face of economic challenges. However, the impending AI revolution poses new risks. Considering the points above, organisations now need to work towards building resilient workforces. They could consider offering competitive salaries as well as upskilling their teams in machine learning technologies ethically and responsibly.

As the job markets tighten and AI becomes more part of our every day, the most successful will be those who embrace change and adapt to the future of work.

We hope this quick snippet of the OECD’s findings has been useful, for more guidance on salaries feel free to reach out to one of Harvey John’s specialist recruiters.

Author

As a liaison with the Board, Operations, & Finance, she measures the effectiveness of marketing initiatives. Through coordinated research and content marketing, Katie ensures Harvey John stays ahead in the agile recruitment landscape, offering our network a unique perspective on the market.