Harvey John

Unit 2 Ferry Wharf

Hove Enterprise Centre

Basin Road North

Portslade, East Sussex

BN41 1BD

Becoming a tax partner isn’t for the faint of heart, especially in the world of top accounting firms. Making partner is the apex of a career in professional services and it’s always taken a huge amount of commitment to get there from those with the eyes set on this seat.

Making partner today, however, is different to how it’s previously been.

In a world where we find three generations in the workplace, the accountancy realm grapples with the task of fostering a new generation of partners, equipped to tackle ever-evolving work cultures and shifting attitudes from a largely millennial and now, Gen Z, workforce. As such, the journey to partnership is undergoing a modern makeover. Out with the old, in with the new – the traditional career trajectory is getting a facelift to better align with the expectations of modern professionals.

Today, achieving a partnership no longer necessitates sacrificing your personal life at every turn. Thanks to a burgeoning trend towards improved work-life balance, partners can thrive professionally while still enjoying their personal lives – well, some of them!

But, let’s not sugarcoat it: the expectations of a partner remain towering, making it a role that demands resilience, dedication, and hours of work.

So if you’ve been eyeing up a partnership, you might be thinking how do I get there? Here’s a guide on what you need to know to become a tax partner.

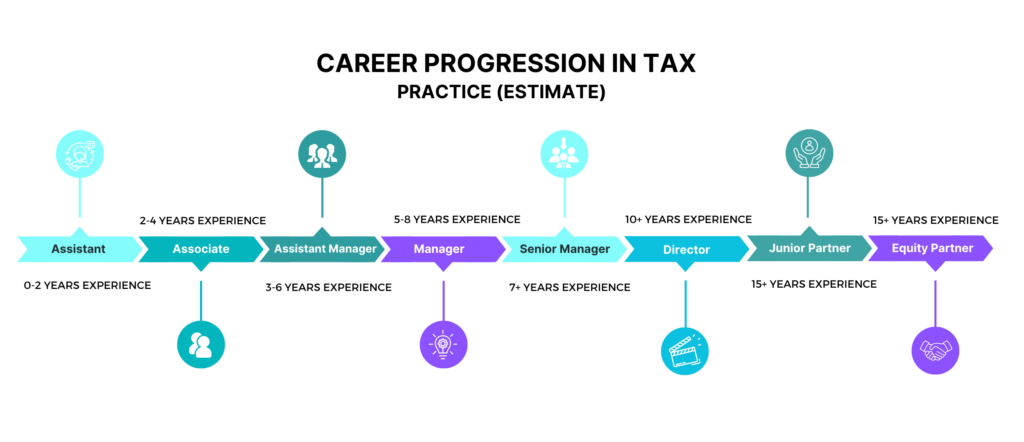

What does career progression look like for a tax professional?

The timeline for progressing from entry-level to partner can vary significantly. Ultimately, it’s influenced by an array of variables, for instance:

- Individual performance

- Your chosen niche

- Size of firm

- Size of team

- Firm structure and policies

- Internal advancement programmes & opportunities

- Mentoring

- …and sometimes, a bit of luck!

As a rough estimate, the journey to ‘partner’ is typically 12 to 20 years.

How to get ahead?

Contrary to what many think, getting an edge on your peers and securing that coveted partnership, goes way beyond technical ability.

- Soft skills are paramount. Partners should be ‘rainmakers’ — those who become partners are rarely those who are technically the best. Instead, they’re often those with the charisma and gravitas that goes hand in hand with winning business and influencing the market.

- Credentials are also important. Very rarely will we see tax partners be appointed these days if they aren’t qualified (and this is more important in certain countries compared to others, for example the UK, Ireland, Germany, and Poland). The only exception here is tax technology, a topic we’ll explore in more detail in another blog.

- With the tax community growing rapidly, pinpointing your niche is pivotal — specialising in tax discipline like indirect tax, corporate tax, personal tax etc. is no longer enough. With the tax population growing, you need to find your niche in industry sectors or particular services within your discipline, such as compliance. It’s all about developing an ‘inch wide, mile deep’ approach to your career.

Carving out your territory — whether through innovation, specialised knowledge, or unique value propositions — sets you apart and strengthens your case for climbing the ranks to partner status.

What’s the difference between salaried partners and equity partners?

While the traditional partnership model still carries weight, there’s been a surge in the number of professionals being appointed as a ‘salaried partner’.

What is a salaried partner? Consider it a bridge between the ascent and the apex — a place where you have the peer and market recognition of being a partner but, internally, you haven’t quite taken on the full weight of equity partnership commitments. Ultimately, unlikely an equity partner who is ‘self-employed’, salaried partners are still employees.

The path of the salaried partner isn’t, however, without its critics. Firms can’t make everyone an equity partner but they know they need to retain some of their big hitters; ergo, we see the rise of the salaried partner model. As such, many have seen the role as a reflection of the inflated titles that the market has begun to see. Interestingly, we are even seeing the strategic use of job title in the ascent to partnership with a newer ‘Associate Partner’ grade working its way into the Big 4 model (as well as other various accounting firms across the mid and top tier).

While most tax professionals still aspire to attain equity partnership, which comes with higher earning potential (albeit with its own tax considerations), these coveted positions are growing scarce. Consequently, many professionals are exploring opportunities beyond the confines of the Big 4 in search of greener pastures.

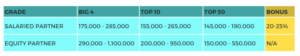

Below is a breakdown of the average earnings for both salaried and equity partners in the indirect tax space of UK practices.

*Data from the Harvey John Indirect Tax Salary Guide

You can find more information on partner salaries across Europe in our tax salary guides.

Partnership isn’t for everyone…

But let’s remember – not everyone is aiming for partnership. Research by our Head of Operations, Sandra McKinnon, during her MBA thesis, The Succession Planning Crisis in the Accountancy Profession: An Investigation into the Partner Talent Gap in Accountancy Firms in the UK Regional Cities in 2017 revealed that only 19% of tax professionals have their sights on the partner track.

Reaching the summit of tax partnership in the accountancy practice market is no small feat. Success in the tax world isn’t just about climbing the ladder; it’s about finding your path to fulfillment, whether that’s as an equity partner, a salaried partner, or forging ahead in emerging fields like tax technology.

With an evolving career landscape, diverse specialisations, and a range of pathways for success, the journey of a tax professional is as exhilarating as it is rewarding. So, strap on your climbing boots and get ready for the adventure – because the view from the top is worth every step of the climb.

Author

As a liaison with the Board, Operations, & Finance, she measures the effectiveness of marketing initiatives. Through coordinated research and content marketing, Katie ensures Harvey John stays ahead in the agile recruitment landscape, offering our network a unique perspective on the market.