Harvey John

Unit 2 Ferry Wharf

Hove Enterprise Centre

Basin Road North

Portslade, East Sussex

BN41 1BD

It is the age-old question facing trainee accountants setting off on a new career. Do you choose the well-trodden path of a career with Deloitte, EY, PwC or KPMG (known collectively as the Big 4), or do you opt for a smaller, regional firm?

How does the size of an accountancy firm impact your career and determine whether you can find that prime job? Does your CV need the stamp of approval of one of the accounting giants?

One thing is for sure, the power and influence of global leaders are showing few signs of diminishing.

The Institute of Chartered Accountants in England and Wales (ICAEW) noted that in 2018, every single company in the FTSE 100 was audited by one of Deloitte, PwC, KPMG and EY.

Meanwhile, in 2019, the Association of Chartered Certified Accountants (ACCA) reported the findings of the IAB World Survey, which revealed that the Big Four have pulled further away from the mid-tier in terms of revenue.

In 2022, the global market shares were:

Find more statistics at Statista

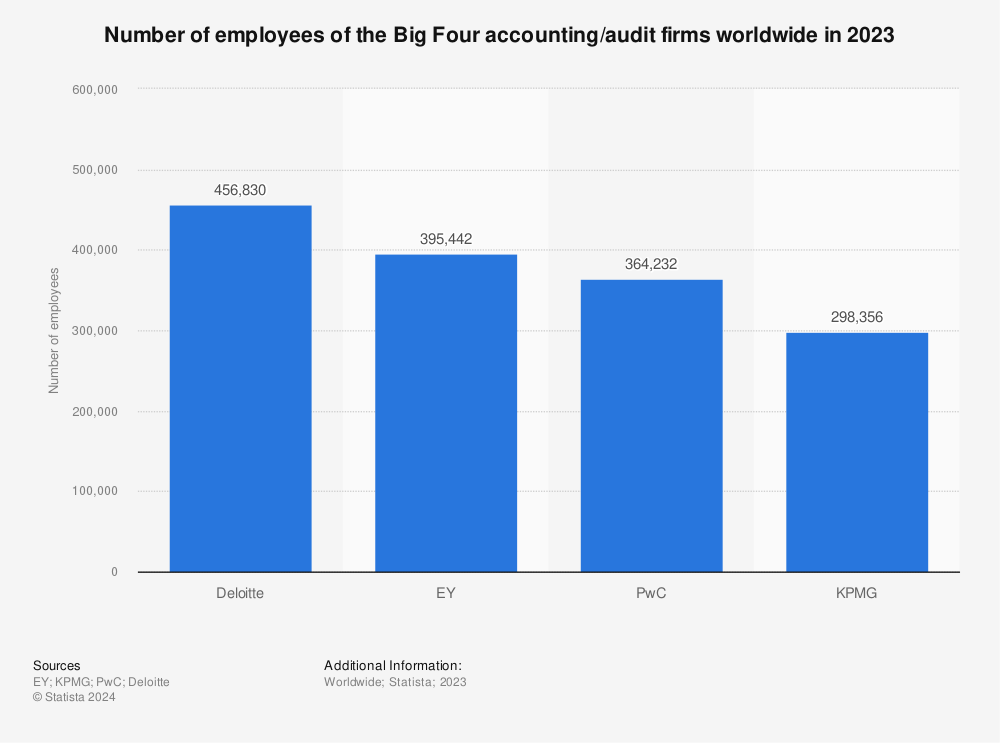

* Number of employees of the Big Four accounting

With almost two-thirds of the global market share and 1,091,332 employees, it is no wonder they are known as the Big 4.

So is it a case that if you can’t beat them, join them?

Go big or go home

If you join one of the global brands, there will be clearly defined opportunities for advancement. Armies of accountants have passed through refined and strenuously tested development programmes. Your efforts will be monitored and appraised. Work hard, do the long hours and strive to impress, and then you will progress along a structured reward path.

You know where are with the big guys – but just getting in the door is a challenge. It’s not easy to land a job at a Big 4 firm. Out of a hundred applicants, only five to seven typically get offers.

If your work ethic is spot on, then you can take advantage of the opportunities of a diverse organisation. You can move laterally within the firm, allowing you to get involved in very different sectors or functions.

As well as offering highly researched programmes, the Big 4 invest millions in their diversity programmes and their business culture. They want to attract the best talent so invest heavily to be recognised as a great place to work. They all work on employee engagement to boost their position on Fortune’s 100 Best Companies to Work For.

“The Big 4 invest millions in their diversity programmes and their business culture. As they all want to attract the best talent, they invest heavily to ensure they are recognised as being a great place to work”

Where Big 4 firms have a clear edge is their network and contacts book. Big4accountingfirms.org elaborates on this: “Exposure is one of the greatest things about going into a big firm. Even as an intern at a [Big 4] firm, you’ll be introduced to and possibly have the chance to work with CFOs and CEOs of large corporations.”

Finally, there is the coveted brand name to drop into the CV. When a future employer sees Deloitte on your employment history, it’s not going to do any harm.

Caroline Clarke, a Director at Lewes-based accountancy firm Andrew M Wells, notes: “The training you receive and support is excellent. Having time off to study is a big advantage and really enables you to focus on the exams. Larger firms are certainly more formal and well-structured and this will really suit some people. You often get to work with high-profile clients and more travel is involved, which can be interesting.”

Small is beautiful

Working in a global institution, where you are just another small cog, is not for everyone. Training at a small accountancy firm can be a far more rewarding experience.

SME advice site, AllBusiness extols the virtues of smaller firms, which offer a more well-rounded accountancy service: “Smaller firms generally have a cosier, warmer, and friendlier atmosphere, which makes for a more personal and more welcoming environment to work in. Employees can enjoy a more hands-on experience, and a chance to really get to know their clients. They are also more likely to feel that they are serving their community in a more personalised way.”

Smaller firms tend to offer a better work/life balance and also have greater loyalty to their staff. When working in a small firm, there is a greater level of emotional investment.

“When working in a small firm, you become part of the family and there is a greater level of emotional investment.”

Caroline Clarke sees the clear positives in working for a smaller firm: “The variety of clients and sectors that you get involved in, the close contact you get with clients, and the excellent working relationships you can develop, are all positive aspects of working in a smaller firm. Also, you feel a great sense of ownership and you can really make a difference.”

Which is better?

We asked Caroline Clarke, Director at Clark + Wells, and Mark Crowter, a Partner at Galloway’s for their verdicts:

Caroline Clarke

When starting out on an accountancy career is it better to train at a large or small firm?

“This depends on where you see yourself in the future. If you want to work in a commercial role or specialise in a particular area, then a larger firm may be best, as it may provide this expertise. If you want all-around training with a view to running your own practice in future, then a small firm is an ideal starting point.”

Caroline Clarke is a Director at Clark + Wells, an independent accountancy firm in Lewes.

Mark Crowter

“I’ve worked in practice for 15 years and over that time I’ve had a lot of advice about how and where people need to work. Questions about needing to work in London or at a top 10 firm, in order to build out your CV are really common for people new to the industry.

I think these questions entirely miss the point.

If I asked you to drive to a destination, the first thing you’d probably do is pull out your phone and open Google Maps to plot a route to the place you want to get to. Your career will be much the same. For some people, that means you have to go via the Big 4 – you’re more likely to be the CFO of a listed business if you’re Big 4 trained – but that’s not the destination for everyone.

What’s really important is to think about your values, your goals and be honest about your skill set. I was lucky enough to spend nearly a decade of my career in a top-10 firm with some of the most wonderful people I’ve ever met. I learned a lot, built a great network and had a huge amount of fun but have always felt it was my vocation to work in more local practice, as it allows for much greater balance and a far deeper relationship with my clients.

From my experience, working in a large firm does naturally silo your skillset. You’ll be an auditor or working in financial reporting or corporate tax or some other specific service line. Whilst this can limit your ability to be a good quality ‘all-round advisor’, there is a lot of scope for secondments and a much deeper internal training system. Whilst you have to go out of your way to find these experiences, if you want to be an all-rounder, you can still get there.

I would also suggest ignoring the CV building. When I recruit, I want to hear stories about how much people love what they do and how much they care for their clients.

Do what you enjoy and what will lead you to the role and lifestyle that you’re after.”

Mark Crowter is a partner at Galloways, the fastest-growing accounting services firm in Sussex, employing over 100 people.

—

Claire Jones is the Principal Consultant in the Accountancy Division at Harvey John.

Search our latest accountancy jobs here.

If you would like to see our company updates and industry insights, follow our LinkedIn page here.

Author