Harvey John

Unit 2 Ferry Wharf

Hove Enterprise Centre

Basin Road North

Portslade, East Sussex

BN41 1BD

Welcome to Harvey John’s quarterly Accountancy Market Insights, featuring the latest hiring trends, job market predictions, and updates in accountancy and finance. This Q1 issue covers accountancy recruitment including hiring trends, salary comparisons, market predictions, and job search tips for professionals.

In today’s rapidly evolving job market, finding and hiring the right talent is more important than ever before. As a trusted resource in the recruitment industry, our goal is to help you stay informed, up-to-date, and connected with the latest developments and opportunities.

So, whether you’re a qualified hiring manager, or a young professional looking to make your mark in the world, we invite you to join us and explore the latest trends and insights that can help you succeed.

What did last quarter look like?

Q1 has witnessed significant activity with the Financial Services, Legal, Retail & Travel industries exhibiting the most substantial demand for accounting professionals. It’s great to see that the travel industry has picked up after covid and many people have holidays booked.

Let’s take a recap of what happened in the last 3 months.

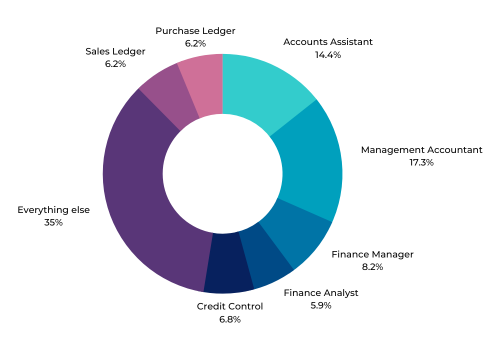

Accountancy roles with the highest client demand

Accounts Assistant & Management Accountant vacancies took the lead this quarter. However, if we group Accounts Assistants, Sales Ledger, and Purchase Ledger opportunities together as transactional finance, these account for the lion’s share of new jobs.

Georgina Trudgill our Associate Director of Accountancy, offered some insight on how she found Q1:

We’ve seen a strong start to the year for many of our clients. When sales and business activity increase, this often prompts the need for additional assistance across the transactional finance functions that first feel the immediate volume shift. This will then feed into part-qualified level reporting and analytical opportunities in the upcoming months which is where we expect demand to increase this upcoming quarter. This is already being seen in recent weeks.

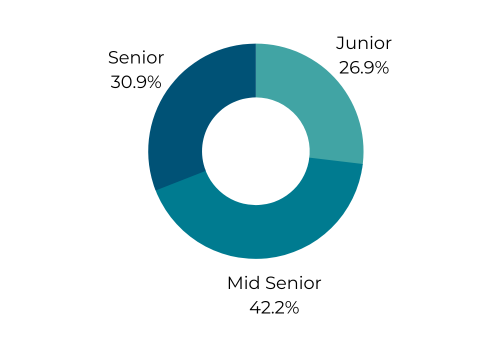

An Overview of the junior and senior accountancy market

Our analysis of Q1 indicated a significant demand for junior-level hires, with a growing number of clients providing opportunities for individuals in the early stages of their finance careers. This included good availability for graduates and AAT studiers entering the market.

- Junior level 42.13%

- Mid senior 38.03%

- Senior 19.84%

This is great news for those at the beginning of their accountancy career.

What qualifications are most in demand?

One of the most common questions asked is ‘What is the best qualification for me to become an accountant?‘ Let’s find out what the highest requirement was in terms of qualifications:

- No qualifications required 36.27%

- ACA/ACCA/CIMA 35.54%

- AAT 28.19%

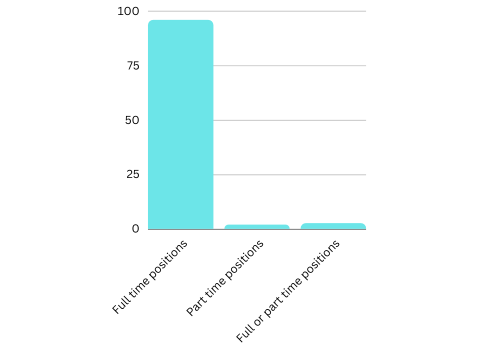

How many part-time accountancy & finance jobs are there?

During the last quarter, part-time positions constituted 11.90% of all available vacancies, representing a 70% surge from the previous quarter. This increase is a positive development for those who require reduced working hours.

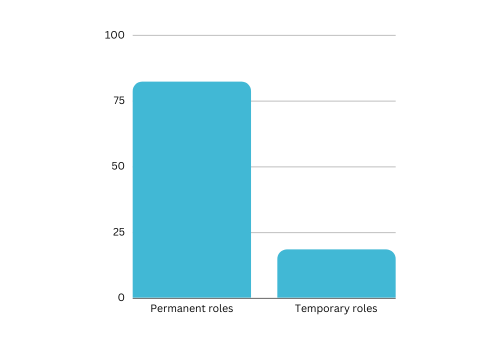

The breakdown of permanent and temporary & interim accountancy jobs

Permanent hires were the most sought-after by employers, taking up 82.04% of the market. The remaining 17.96% was occupied up by both temporary and contract positions.

What are the average salaries for accountants?

So, what did the market suggest that the average salaries were last quarter for those sought-after roles? The following data is provided to offer guidance on the range of remuneration that could be negotiated for these roles and to facilitate a comparison of your current salary against industry benchmarks.

- Accounts Assistant | £25,000-£27,500

- Credit Control | £27,500-£30,500

- Assistant Accountant | £30,000-£36,000

- Management Accountant | £42,500-£49,500

- Finance Manager | £47,500-£56,000

Callum McKenna, our Associate Director offered some insight on factors to consider when negotiating salaries:

Consider the location and nature of the role when evaluating compensation. Proximity to London may affect compensation, and remote work options may also impact salaries. Certain roles, such as credit control, may allow for higher salaries when working remotely for a London-based business compared to local opportunities. Role content and level of responsibility must also be considered, as job titles can differ. A role involving more complex finance duties typically warrants higher compensation based on the level of responsibility. Career progression should also be taken into account during salary negotiations, as candidates may accept a lower salary if growth opportunities are available.

What did last quarter look like for accountancy firms?

Breakdown of jobs by grade

Accountancy firms observed a surge in mid to senior-level roles during the quarter. Great news for those looking for a step up in their existing practice career.

Our Managing Director, David Waddell who manages senior finance had some insight to offer on this:

“Regardless of this market snapshot, be reassured that the practice market continues to be buoyant in terms of opportunities across all service lines and across all levels. My advice to anyone considering changing jobs in practice would be not to worry about whether there are opportunities for you in the market but more that you are 100% committed to a move because the market is moving very quickly so you need to be absolutely certain that a change of employer is really what you are looking for. We are of course happy to chat through your particular requirements.”

Roles with the highest client demand

The following roles were of the highest demand for Public Practice:

- Accountants across both junior and senior levels | 34.60%

- Tax across both junior and senior levels | 26.96%

- Accounts Technicians/Associates | 20.10%

- Audit across both Junior and Senior levels | 18.34%

Accountants from junior to senior level took the lead last quarter, followed by Tax. If you are an accountant in Practice looking for your next role, please do not hesitate to contact us.

How many part-time jobs are there?

Full-time positions in practice vastly dominated the market with a staggering 95.85% of roles. However, if you are looking for a role with more flexibility in your next role, whether that is around days and hours of work, please contact our public practice consultants.

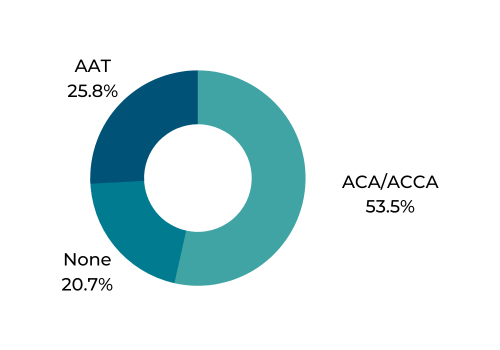

What qualifications are most in demand?

Across Q1, the most sought-after qualification for the majority of positions was ACA/ACCA, accounting for 53.5% of the requirements. AAT requirements came in second.

If you are embarking on your accountancy career and evaluating the qualifications necessary to advance, we recommend this as essential reading to really understand how you can map out your development. This article by Georgina Trudgill provides valuable insights into the qualifications that align with your career goals.

Claire Jones our Principal Consultant for public practice, offered some insight of her experience around qualifications for last quarter.

Looking at the jobs I’ve registered in the last quarter I would say the same – ACA and/or ACCA qualification is the most sought after, or candidates who are least part qualified. After that, it is AAT and ATT. We are seeing the market continues to be busy at all levels, from trainee accountant to senior manager level, with our clients continuing to be busy and seeing no slowdown in demand at the moment. Demand for suitably qualified and experienced candidates continues to outstrip supply.

What are the average salaries in accountancy?

What did last quarter suggest that the average salaries for professionals working in practice? Let’s take a look…

- Accounts Associate | £26,000-£30,000

- Trainee Accountant | £25,500-£28,500

- Audit Assistant | £25,000-£30,000

- Semi Senior Accountant | £31,500-£37,500

- Audit Senior | £40,000-£45,000

- Senior Accountant | £40,000-£53,500

Our Consultant for Public Practice has offered some insight:

Based on my knowledge of the current job market, I would say that the demand for accountants and tax professionals is still high. Unsurprisingly, Audit is still struggling to hire across both junior and senior levels. Overall, the market is still offering a wide variety of roles for candidates, and there is flexibility available in terms of job functions and levels.

Predictions for the upcoming months

Although news about the UK economy remains bleak, the accountancy and finance sectors remain to be strong, valuable assets to the economy.

At Harvey John, we have had two exceptionally busy years of record-breaking activity. The recruitment industry is anticipated to stabilise and become less hectic. A period of stabilisation should not be viewed negatively as activity levels remain high when assessing data from the previous years.

Some key factors impacting the job market:

- Retiring workforce | More workers are expected to exit the market than workers entering.

- Labour market contracting | This will mean less competition and more options/buying power for job seekers

- Salary increases | The decrease in competition within the labour market may result in a continued rise in salaries. According to the Office for National Statistics, between November 2022 – and January 2023, the private sector’s average salary increase was 7%.

- Brexit | Continual changes and debates around immigration policies could impact the ability to recruit skilled workers from the EU and the wider Worldwide market. Several pivotal EU-derived employment laws will leave UK legislation in Dec 2023 unless an extension is granted.

Counter offers | Are they worth it?

You’ve had a successful interview, received a job offer, go to hand in your notice but then… Your employer wants you to stay. They present you with a counteroffer. What do you need to know about this?

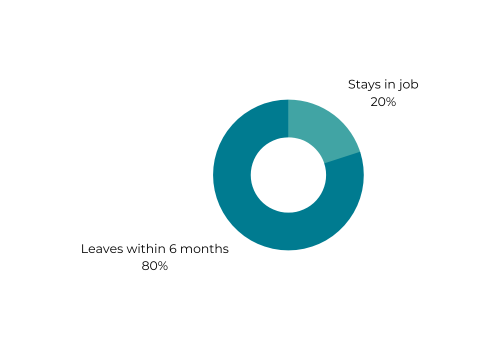

Statistically, counter offers are something that happens 42% of the time when employees hand their notice in, according to Eclipse Recruitment Software.

Something to bear in mind…

57% of employees accept counter offers made to them, with 50% of those being active in the job market again within 60 days. A staggering 80% of candidates who accept counter offers end up leaving their job within 6 months.

What should you take from this?

Receiving a counteroffer can be a tempting proposition, but it’s important to consider these factors before accepting a counteroffer: why you wanted a new job in the first place, evaluate the offer carefully including any conditions, consider long-term implications of an internal salary jump, think about your career goals, and reflect on the impact to internal relationships.

—

Take a look at the latest Accountancy vacancies.

Author

She’s highly attentive to every assignment ensuring a quick moving and effective process in which no stone is left unturned in her search for the perfect match. An understanding and dedicated recruiter, she leverages her industry knowledge and network to deliver the best results for clients and candidates alike.