Harvey John

Unit 2 Ferry Wharf

Hove Enterprise Centre

Basin Road North

Portslade, East Sussex

BN41 1BD

As the tides of inflation raise salaries, businesses are rethinking their hiring strategies. In 2023, a striking shift is evident: while London’s job market remains steady, job openings outside the capital have surged by 25.6% compared to pre-pandemic 2019.

Whether the UK is actually headed for a recession is up for debate but researchers from the economic think tank, the National Institute of Economic and Social Research, predict that there’ll be an increase in debt and unemployment over the next year. On the other hand, the Bank of England remains optimistic, stating that although the economy will be sluggish, it is unlikely we’ll enter a recession.

Regardless of these predictions, it is impossible to ignore the cost of living crisis that’s been impacting millions across the UK. People are struggling to afford the necessities and rising inflation is doing little to combat this. Combining this with costly commuting costs and rail strikes, it’s no surprise that organisations are beginning to branch outside of London when it comes to hiring.

The rise of regional tax recruitment and the levelling of the playing field

London’s once-firm grip on the job market appears to be loosening, with vacancies witnessing a substantial 43.4% drop this year. In contrast, other regions are experiencing a milder decline of 26.2%, reflecting a distinct shift in employment dynamics.

This metamorphosis finds its roots in the evolving paradigms of remote and hybrid working. Businesses are recalibrating their strategies, leading to a reduction in London’s footprint. In this transformation, cities like Manchester, Birmingham, and Edinburgh are thriving as regionalisation gains traction, claiming a larger share of the economic pie.

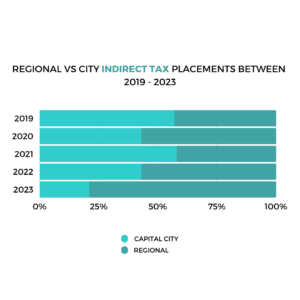

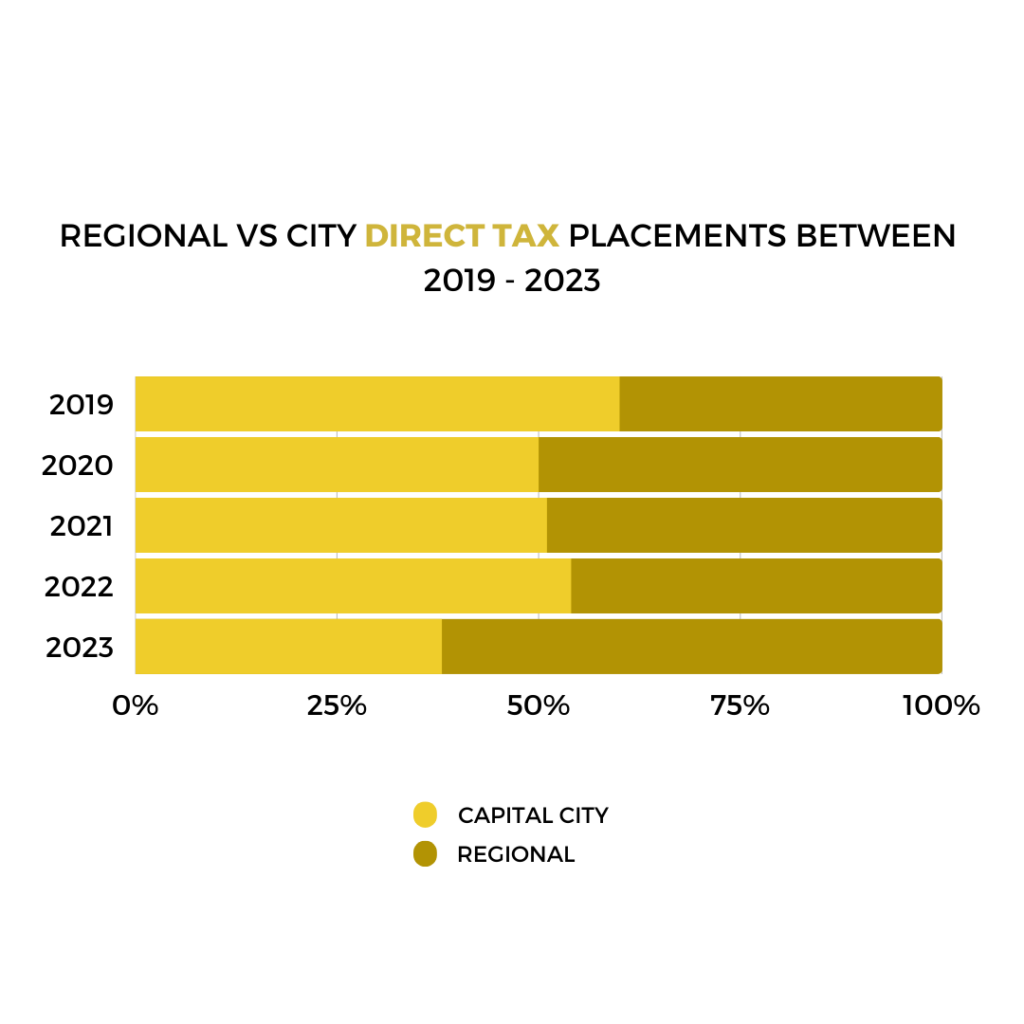

With this report in mind, our Head of Tax, Alex Mann, and I have documented how this trend has impacted the tax market since 2019 with a snapshot of our placements.

Many firms, notably the Big 4, have tried to move the dial on their regional growth and relocated or expanded service lines away from their traditional home in the capital. As such, being ‘physically’ present in London has become far less of a commercial and professional necessity for tax professionals. One Big 4 meeting that our tax team attended this year was explicitly focused on how they will rally their regional recruitment efforts up until 2025 and would prioritise non-London applications.

So what are we seeing when it comes to salaries? Harvey John’s Salary Guide found that the average salary for a Tax Manager working in a professional services firm in London is £73,750 compared to £57,860 in the Midlands, and £51,300 for those in the North. While this may seem like a considerable discrepancy, the average house in London is £780,337 while it is £294,408 in Manchester and £282,316 in Birmingham. According to the online cost of living calculator Numbeo consumer prices in Birmingham are 39.6% lower than in London, and 35.8% lower in Manchester.

There has been a marked shift in employee priorities since Covid 19, and while compensation is still the main motivation for most candidates, flexible working and work-life balance is often the deciding factor when it comes to accepting a new role. Regional offices offer businesses the opportunity to attract exceptional talent without paying London weighted salaries. Employees have access to lower property prices, shorter commutes, and better work-life balance.

Recruiting for firms in the Home Counties, however, has become increasingly more complex as the greater flexibility around hybrid workings has meant that those living within a reasonable proximity to London can still enjoy a city weighting while commuting in 2-3 days a week. The best of both worlds.

Another notable instance where the playing fields have started to level has been how the rise of remote work has expanded earning opportunities for candidates in regional areas, especially for in-house tax positions. With companies embracing remote arrangements, geography matters less, enabling professionals outside major cities to access competitive salaries without relocation. This shift prioritises skills and performance over location, promoting inclusivity and levelling the job market for regional job seekers.

Looking ahead to a new era of recruitment

As the competitive landscape of London transforms so, too, do the opportunities and considerations for job seekers and employers alike. This shift reflects not just the impact of inflation but a larger narrative of adapting to new modes of work and growth.

As the year unfolds, these shifts will continue to influence the professional landscape, redefining the city’s competitive edge.

The question is, will London – and other capitals around the world – bounce back? With ongoing reports of businesses tightening their remote and hybrid working policies, we could see power being restored in London. Yet, with so many forces at play, it’s too early for us to call.

What’s your prediction on the future of the city versus region power dynamic?

___

If you want to see more detail on how London salaries compare to the rest of the UK, get your free copy of our Tax Salary Guides for both direct & indirect tax. And if you’re exploring the London job market, reach out.

Author

Prior to joining the recruitment industry, Ewa had a career in real estate in New York City & London. She prides herself on working closely with clients and candidates to help them to find the best match for their requirements and career objectives.

Ewa is happy to converse in English, German, Italian as well as her native Polish.